Wills & Estate Planning: Comprehensive Solutions by Solicitors

Wills & Estate Planning: Comprehensive Solutions by Solicitors

Introduction

When it comes to safeguarding your family’s future, making a will and creating a sound estate plan are two of the most important steps you can take. A will sets out who should inherit your assets and who will carry out your wishes after your death. Estate planning goes further, covering tax planning, trusts, and powers of attorney to protect you and your family during your lifetime as well as afterwards.

Despite how essential these arrangements are, many people in Hertfordshire delay them or attempt to handle them on their own with the help of online templates. While DIY wills or probate may seem cost-effective, the risks of mistakes are high, and the consequences can be expensive, stressful, and time-consuming. A small error in wording, a missed signature, or an overlooked tax liability can undo the very protection you hoped to create.

This guide explains why working with wills solicitors in Ware provides essential legal and practical protection. It explores the difference between DIY and professional estate planning, the typical costs involved, common pitfalls, and how to make the right decision for your family.

Why a Will is Essential

A will is more than a piece of paper. It is a legally binding guarantee that your wishes will be respected and that your loved ones will not be left in uncertainty after your death. Without a valid will, intestacy rules determine who inherits. These rules are inflexible and may lead to outcomes you would never have intended. For example, unmarried partners or close friends you have lived with or supported may receive nothing, while estranged relatives could inherit the entire estate.

By creating a valid will , you retain control over what happens to your estate. It allows you to:

- Appoint executors who you trust to administer your estate efficiently and fairly.

- Name guardians for children under 18, ensuring they are raised by people you have chosen.

- Specify how money, property, and personal possessions should be distributed.

- Protect vulnerable beneficiaries by setting up trusts that manage assets on their behalf.

- Leave charitable gifts to causes that matter to you.

The absence of a will often creates confusion and conflict among surviving relatives. Families may face disputes, lengthy court processes, and additional legal costs that could easily have been avoided with proper planning. A professionally drafted will minimises these risks, provides clarity, and ensures your legacy is distributed according to your wishes.

The Bigger Picture: Estate Planning

While a will is the cornerstone of future planning, it is only one part of the bigger picture. Estate planning takes a wider view, ensuring your wealth, property, and personal wishes are managed during your lifetime and transferred efficiently afterwards. A comprehensive estate plan addresses both legal and financial matters, protecting your family against uncertainty and unnecessary expense.

Solicitors offering estate planning in Ware typically provide services such as:

- Inheritance Tax Planning – By structuring gifts, using exemptions and reliefs, and planning transfers carefully, solicitors can reduce the tax burden on your estate. Even modest estates can become liable for inheritance tax when property values and pensions are considered.

- Trusts – Setting up trusts allows families to protect wealth, provide for children, or ensure assets are managed responsibly for vulnerable or disabled beneficiaries.

- Lasting Powers of Attorney (LPAs) – An LPA authorises someone you trust to manage your financial or health affairs if you lose mental capacity. This ensures your wishes are respected even if you cannot make decisions yourself.

- Business Succession Planning – For company directors or business owners, estate planning also involves preparing for the smooth transfer of business assets or safeguarding the enterprise for the next generation.

- Property Planning – From dealing with jointly owned property to protecting family homes for future generations, solicitors provide strategies that prevent assets being unnecessarily lost or consumed by tax or care fees.

Handled properly, estate planning gives peace of mind in life as well as clarity after death. It ensures your family avoids unnecessary conflict and financial hardship, while your assets are preserved for those you care about.

DIY vs Professional Wills and Probate

The Appeal of DIY

DIY wills and probate services are attractive because they are inexpensive and appear straightforward. Many supermarkets and online providers offer will kits for under £50. Probate, too, seems manageable at first glance—simply filling out forms and applying for the Grant of Probate. For very small and uncomplicated estates, these options can sometimes be effective.

The Risks of DIY

Unfortunately, the reality is often different. DIY wills and probate come with serious risks that may only become apparent after death, when it is too late to correct them. Common problems include:

- Incorrect witnessing of the will, making it legally invalid.

- Ambiguous wording that leaves room for disputes and litigation.

- Failure to account for inheritance tax, leaving families with unexpected liabilities.

- Omitting assets, which can trigger partial intestacy.

- Executors underestimating the time and responsibility involved in probate, which can lead to costly mistakes.

When executors attempt DIY probate, they often discover that the process requires extensive documentation, tax forms, correspondence with banks and HMRC, and detailed accounting. The process can easily consume hundreds of hours and errors can result in financial penalties or personal liability for the executor.

The Professional Advantage

Solicitors provide security, accuracy, and reassurance. They ensure wills are properly executed, legally binding, and fully compliant with current law. For probate, solicitors handle the entire process, from collecting assets to distributing inheritances. They liaise with financial institutions, complete complex inheritance tax returns, and apply for probate on your behalf.

Choosing wills solicitors in Ware also comes with the protection of professional indemnity insurance. This means that if an error were to occur, your estate is safeguarded against losses—something no DIY solution can offer.

The Costs of Wills and Estate Planning

One of the most common reasons people delay making a will or seeking estate planning advice is fear of cost. While it is true that professional services are more expensive upfront than DIY kits, the long-term savings and protections far outweigh the initial expense.

Solicitors’ Fees for Wills

- Simple Will: £200–£400 plus VAT

- Mirror Wills (for couples): £300–£600 plus VAT

- Complex Wills with Trusts: £500–£1,200+

Probate Services

- Grant-only service: From £950 plus VAT (solicitor obtains the Grant of Probate while the executor completes the rest).

- Full administration: £3,000–£6,000+ depending on estate size and complexity.

DIY Costs

- Will kit: £30–£50

- DIY probate: Court application fee of £300 (for estates over £5,000), plus additional disbursements.

While the DIY route may appear cheaper, the hidden costs of mistakes, disputes, and invalid documents can quickly escalate. Professional support provides peace of mind and avoids costly problems further down the line.

Common Scenarios: DIY vs Solicitor Outcomes

- Hertfordshire DIY Will Gone Wrong – A family used a £30 will kit. The will was signed incorrectly, making it invalid. As a result, intestacy rules applied, and the partner of 20 years was left with nothing. She had to pursue a stressful and expensive legal battle to claim a share of the estate.

- DIY Probate and Tax Penalties – Executors of a £500,000 estate attempted DIY probate but miscalculated inheritance tax. HMRC issued penalties for underpayment, and solicitors had to be brought in to correct the mistake. The final legal costs exceeded what professional probate fees would have been in the first place.

- Professional Planning Success – A Ware couple instructed solicitors to create mirror wills and establish trusts. Their estate plan reduced their inheritance tax liability by £120,000 and ensured assets passed seamlessly to their children without dispute.

Why Choose Wills Solicitors in Ware?

Local expertise matters when it comes to wills and estate planning. Solicitors based in Ware understand the needs of Hertfordshire families and provide services tailored to the community. At The Probate Bureau, we pride ourselves on:

- Transparent, fixed-fee pricing so you know exactly what to expect.

- Efficient turnaround, with many estates completed within six months.

- Comprehensive services covering wills, trusts, probate, and estate planning.

- Compassionate support that recognises the sensitive nature of planning for the future.

Since 1999, we have supported thousands of families across Hertfordshire, earning trust through professionalism and care. We are also recommended by more than 1,000 funeral directors, reflecting the depth of our reputation in the community.

FAQs

1. Can I write my own will?

Yes, but errors are extremely common. A solicitor ensures your will is legally binding and reflects your wishes clearly.

2. How often should I update my will?

It is wise to review your will every five years or whenever major life changes occur, such as marriage, divorce, or buying property.

3. What happens if I die without a will?

The law applies intestacy rules, which may result in assets going to relatives you never intended to benefit. Unmarried partners, stepchildren, and close friends often receive nothing.

4. How much does probate cost in Hertfordshire?

Professional probate fees start at £950 plus VAT for a grant-only service, with full estate administration depending on estate size and complexity.

5. Can solicitors help reduce inheritance tax?

Yes. By using trusts, exemptions, and estate planning strategies, solicitors can significantly reduce or even eliminate inheritance tax liabilities.

Conclusion

Making a will and planning your estate are vital steps in protecting your family and your assets. While DIY options may look affordable, they often create disputes, invalid documents, and hidden costs. Professional wills solicitors in Ware provide the legal expertise, reassurance, and protection your family needs.

At The Probate Bureau, we are committed to delivering clear, fixed-fee solutions that take the stress out of wills, probate, and estate planning. Our goal is to ensure your estate is managed efficiently and in line with your wishes, giving you and your loved ones complete peace of mind.

Contact us today to discuss how we can help you protect your family’s future with a professionally drafted will or a comprehensive estate plan.

Back To BlogShare This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

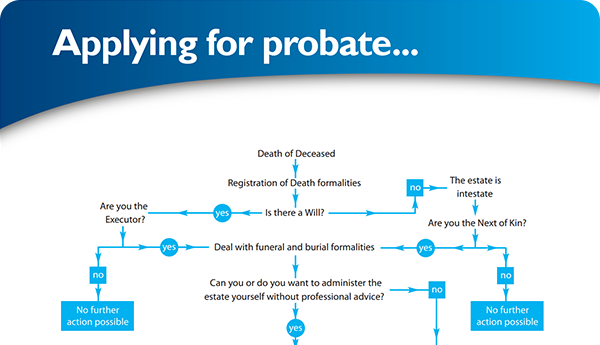

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×