Secure Your Future Decisions

Power of Attorney Hertfordshire: Secure Your Future Decisions

Introduction

Planning ahead is one of the most important ways to protect your family and your future. Most people are familiar with making a will, but fewer realise that a Power of Attorney is just as vital. While a will governs what happens after your death, a Power of Attorney safeguards you and your affairs during your lifetime if you lose the ability to make decisions.

Across Hertfordshire, families are increasingly recognising the value of putting Powers of Attorney in place early. Without them, even your closest relatives may be left powerless to make essential financial, legal, or healthcare choices when you need them most. At The Probate Bureau, based in Ware, we specialise in helping local families arrange Power of Attorney Hertfordshire services that are legally sound, practical, and tailored to their needs.

This comprehensive guide explains what a Power of Attorney is, why it matters, the dangers of DIY approaches, the costs of professional help, and how to make the right decision for your circumstances.

What is a Power of Attorney?

A Power of Attorney is a legal document in which you (the “donor”) appoint one or more trusted individuals (your “attorneys”) to make decisions on your behalf. These decisions may relate to finances, property, or health and welfare. There are two main types of Lasting Power of Attorney (LPA) in England and Wales:

1. Property and Financial Affairs LPA

This allows your attorneys to manage bank accounts, pay bills, deal with investments, handle pensions, collect benefits, and even buy or sell property on your behalf. It can be used as soon as it is registered with your consent, or only if you lose capacity.

2. Health and Welfare LPA

This covers decisions about your medical treatment, care needs, living arrangements, and day-to-day welfare. Unlike the financial LPA, this can only be used if you are unable to make decisions yourself.

Together, these documents ensure that someone you trust can act quickly and effectively on your behalf, avoiding delays and uncertainty.

Why a Power of Attorney is Essential

Life is unpredictable. Sudden illness, accidents, or age-related conditions such as dementia can leave people unable to manage their own affairs. If you do not have a valid LPA in place, your family will have to apply to the Court of Protection for permission to act.

This process is:

- Slow: Applications can take nine months or longer.

- Expensive: Court fees and legal costs often exceed £3,000.

- Stressful: Families are forced to navigate a complex legal system during an already emotional time.

In contrast, if you already have an LPA registered, your attorneys can act immediately, paying bills, accessing funds, and arranging care without unnecessary obstacles.

DIY vs Professional Power of Attorney

The DIY Option

Government forms are available online for individuals who want to create LPAs themselves. This seems appealing because the upfront cost is lower and you only need to pay the registration fee. For very simple cases, DIY LPAs can work. However, errors are extremely common. Common DIY mistakes include:

- Signing and witnessing in the wrong order.

- Failing to complete sections properly.

- Using ambiguous wording that causes confusion later.

- Not registering the LPA promptly with the Office of the Public Guardian.

If mistakes are made, the LPA will be rejected, and if the donor has already lost capacity by that stage, it will be too late to correct the errors. Families are then left with no choice but to apply to the Court of Protection.

The Professional Option

Solicitors offering Power of Attorney Hertfordshire services ensure your documents are completed correctly, signed and witnessed properly, and registered without delay. They also help you consider important decisions such as:

- Who to appoint as attorneys.

- Whether attorneys should act jointly or independently.

- What restrictions or guidance should be included.

- How to integrate LPAs into wider estate planning.

Professional support not only guarantees legal accuracy but also provides peace of mind that your family will not be left vulnerable.

Costs of Powers of Attorney

Government Registration Fees

- £82 per LPA to register with the Office of the Public Guardian.

- £164 if registering both financial and health LPAs.

- Reductions or exemptions are available for those on low incomes.

Solicitors’ Professional Fees

In Hertfordshire, solicitor fees for preparing and registering LPAs usually range between £250 and £500 per document, depending on complexity. For couples creating both types of LPA, total costs often fall between £600 and £1,200.

DIY Costs

DIY LPAs cost only the registration fee. However, the risk of rejection due to errors is high. If that happens, families may face Court of Protection costs running into thousands. When weighed against the risks, professional fees are a modest investment that saves both money and stress in the long term.

Real-World Scenarios in Hertfordshire

Case Study 1: The Pitfall of DIY

A family in St Albans attempted to complete an LPA online for their father, who was beginning to show signs of dementia. Unfortunately, the signing process was done in the wrong order, and the Office of the Public Guardian rejected the application. By the time they reapplied, their father had lost capacity. The family had no choice but to apply to the Court of Protection, costing more than £3,500 and delaying financial management for nearly a year.

Case Study 2: The Benefits of Professional Support

A couple in Ware arranged both types of LPA through local solicitors. The process was smooth and stress-free, with documents registered within weeks. When one spouse later suffered a stroke, the other was able to immediately access bank accounts, manage household bills, and make healthcare decisions. This prevented financial strain and ensured care decisions were made without delay.

How to Set Up a Power of Attorney: Step by Step

- Choose Your Attorneys: Select one or more people you trust completely, such as a spouse, adult children, or close friends. Consider appointing replacements in case your first choices are unable to act.

- Decide How They Will Act: Attorneys can act jointly (all must agree) or jointly and severally (they can act independently). Each approach has advantages, depending on your circumstances.

- Complete the Forms: Forms are available from the government website or through solicitors. This stage requires precision, as mistakes can invalidate the LPA.

- Sign and Witness Correctly: The donor, attorneys, and witnesses must sign in a specific order. A certificate provider must confirm that the donor understands the LPA and is not under pressure to sign.

- Register the LPA: Send the forms to the Office of the Public Guardian with the £82 fee. Registration usually takes eight to twelve weeks.

- Store Safely and Use When Needed: Once registered, the LPA is a legal document. Solicitors can advise on secure storage and provide certified copies when required.

Integrating Powers of Attorney with Estate Planning

Arranging a Power of Attorney is most effective when combined with broader estate planning. At The Probate Bureau, we recommend:

- Making or updating your will at the same time.

- Considering inheritance tax planning to protect family wealth.

- Setting up trusts where appropriate.

- Discussing your wishes openly with your family to avoid disputes later.

This joined-up approach ensures that both your lifetime decisions and your estate after death are fully protected.

Why Choose The Probate Bureau in Hertfordshire

At The Probate Bureau, we have been supporting families across Hertfordshire since 1999. Based in Ware, we provide clear, fixed-fee services for Powers of Attorney, wills, trusts, and probate. Our reputation is built on:

- Transparent pricing with no hidden costs.

- Efficient service, with LPAs registered quickly.

- Compassionate, personal guidance during difficult times.

- Local expertise trusted by over 1,000 funeral directors.

Frequently Asked Questions

1. Do I need both types of LPA?

Yes, most people benefit from having both. The financial LPA ensures bills and property are managed, while the health LPA covers care and medical decisions.

2. Can I change or cancel an LPA?

Yes, as long as you still have mental capacity. LPAs should be reviewed regularly to ensure they remain up to date.

3. Can attorneys make gifts with my money?

Only limited, reasonable gifts are permitted without court approval. Solicitors can provide guidance on this area.

4. What happens if my attorneys disagree?

You can specify in the LPA how decisions should be made. Solicitors help draft provisions to avoid disputes.

5. What if my attorney misuses their power?

Attorneys are legally bound to act in your best interests. Misuse can be reported to the Office of the Public Guardian and may lead to legal consequences.

6. When should I make an LPA?

As soon as possible. You must have the capacity to make one, so leaving it too late risks losing the opportunity altogether.

Conclusion

A Power of Attorney is one of the most powerful and protective documents you can put in place for your future. It ensures that if you lose capacity, trusted individuals can step in immediately to manage your affairs and make decisions on your behalf.

DIY approaches may appear attractive due to lower upfront costs, but the risks of mistakes are high and the consequences can be devastating for families. Professional Power of Attorney Hertfordshire services, offered by The Probate Bureau, provide legal certainty, compassionate guidance, and peace of mind that your future is secure.

Do not leave your family vulnerable to stress, cost, and delay. Contact The Probate Bureau today and let us help you secure your future decisions with confidence.

Back To BlogShare This Post

Recent posts

- 10 Legal Ways to Reduce Inheritance Tax in the UK (2026 Guide) By Admin , 27/11/2025

- Gifting Assets – How Lifetime Giving Can Lower Your Inheritance Tax Bill By Admin , 27/11/2025

- How Long Does Probate Take? Understanding Every Stage of the Process By , 04/11/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

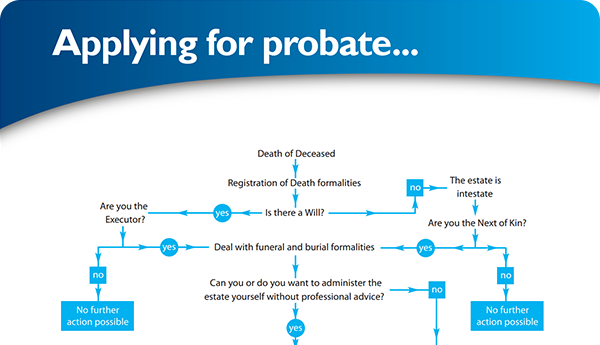

Click here to follow our step-by–step probate process guide

×