Will and Probate Services in Ware & Herts

Your Trusted Partner for Will and Probate

Introduction

Losing a loved one is always difficult, and the last thing most families want to deal with during such a time is complicated legal paperwork. Unfortunately, probate and will administration are unavoidable parts of handling someone’s estate. At The Probate Bureau, based in Ware and serving Hertfordshire, we specialise in guiding families through this complex process. Our focus is on providing expert knowledge, a compassionate approach, and clear guidance to ensure estates are handled correctly and without unnecessary stress.

This article explores what will and probate services involve, whether it is realistic to carry out probate yourself, and the costs associated with using professional support. By the end, you should feel better informed about the choices available to you and whether hiring a solicitor or probate specialist could save you time, money, and stress.

Understanding Probate and Will Services

Probate is the legal process of administering a deceased person’s estate. When someone dies, their property, money, and possessions need to be collected, debts must be settled, and the remaining assets distributed according to a will or the rules of intestacy if no will exists. To carry out this responsibility, executors or administrators usually need a legal document called a Grant of Probate or Letters of Administration.

A properly drafted will is the foundation for a smoother probate process. A will sets out who should inherit what, and can also specify guardians for children, executors to carry out instructions, and wishes about personal belongings. Without a will, the law decides who inherits, which often leads to outcomes the deceased might not have intended.

At The Probate Bureau, we provide comprehensive services that include will writing, probate administration, inheritance tax planning, creation of trusts, and Lasting Powers of Attorney. We aim to be a one-stop resource for families in Ware and Hertfordshire who want both peace of mind and efficiency when dealing with estate matters.

Should You Handle Probate Yourself?

It is possible to deal with probate without professional help. Some people choose to do so because they want to avoid professional fees and retain full control of the process. If the estate is simple, has little value, and does not involve inheritance tax or property, a determined individual could potentially manage it on their own.

However, probate is often more complex than it first appears. Even straightforward estates can involve multiple bank accounts, property valuations, tax returns, and the need to deal with financial institutions that require precise legal documents. Small errors can cause lengthy delays, and missing important forms can result in penalties from HMRC.

For many people, the challenge lies in the time commitment. Executors may spend months gathering information, filling in paperwork, and corresponding with banks, pension providers, HMRC, and the probate registry. During a period of grief, this burden can feel overwhelming.

By contrast, a probate professional or solicitor brings expertise and efficiency. They can ensure all paperwork is completed correctly, deadlines are met, and the estate is administered as quickly as possible. They also provide guidance on inheritance tax reliefs and exemptions, which could save the estate significant amounts of money.

The Advantages of Professional Probate Services

When you appoint a probate specialist, you are not just paying for legal knowledge but also for reassurance and peace of mind. Professionals know the process inside out and can often complete administration in half the time it might take an inexperienced executor.

One of the main benefits of using a professional service is transparency. At The Probate Bureau, we offer clear, fixed fees rather than hourly billing. This ensures that families know exactly what to expect from the outset, with no hidden costs. Many estates without property can be completed within three to six months, which is far quicker than the average waiting time when executors handle everything themselves.

Another benefit is that all related matters can be managed under one roof. Probate is often linked to other legal needs such as will updates, setting up trusts, or arranging Lasting Powers of Attorney. Having everything coordinated by the same experienced team reduces stress and ensures nothing is overlooked.

Most importantly, a professional service frees families from the paperwork, correspondence, and technical details so that they can focus on personal matters and healing.

The Costs of Probate Services

Understanding the cost of probate is essential for making an informed decision. Costs are usually made up of court fees, disbursements, and professional fees.

The probate application fee set by the government is currently £300 if the estate is worth more than £5,000. Additional copies of the Grant of Probate cost £1.50 each. Other disbursements may include fees for placing statutory notices, Land Registry charges, and identity checks.

Professional fees vary widely depending on the provider and the complexity of the estate. Some solicitors charge a percentage of the estate, which can be between 1 and 5 per cent plus VAT. Others work on an hourly rate that often falls between £300 and £400 per hour. A growing number of firms, including The Probate Bureau, offer fixed fees for greater clarity.

For simple estates, fixed fees can start at around £950 plus VAT for grant-only services, where the professional obtains the Grant of Probate but the executor carries out the rest of the work. For more complex estates involving property or inheritance tax, costs typically rise to several thousand pounds. For full administration of an estate, the cost may range from £3,000 to £6,000 or more, depending on the estate’s size and complexity.

The Probate Bureau is known for offering competitive fixed-fee packages that avoid the uncertainty of percentage-based charging. This approach often works out much cheaper than traditional solicitor models and gives families a clear understanding of what the final bill will be.

Why Delays in Probate Are a Growing Problem

One of the biggest challenges in recent years has been delays in the probate system. Even simple estates can take over six months if handled incorrectly, and more complex estates can stretch well beyond a year. This can cause serious financial strain for families who are left unable to sell property or access funds until probate is granted.

Many of these delays are caused by errors in paperwork, missing information, or backlogs within the Probate Registry. Choosing to handle probate yourself increases the risk of mistakes that trigger lengthy delays. By contrast, a professional who understands the requirements can ensure applications are accurate and complete, reducing the chance of problems and saving months of waiting.

At The Probate Bureau, we pride ourselves on efficient turnaround times. Many estates are finalised within three to six months, which is significantly faster than the national average. This speed provides reassurance to beneficiaries and helps families access funds when they need them most.

Deciding Between DIY and Professional Probate

The choice between doing probate yourself and hiring a professional largely depends on the complexity of the estate, your confidence with legal matters, and the amount of time you can commit.

DIY probate might be appropriate if the estate is very simple, there are few assets, no property is involved, and no inheritance tax is due. However, even in such cases, executors must be prepared for significant paperwork and the responsibility of meeting legal obligations.

In most cases, families prefer the certainty and reassurance of professional support. Hiring an expert reduces the risk of errors, shortens the time taken, and ensures compliance with tax and legal requirements. The potential savings in stress, time, and even tax liability often outweigh the cost of professional fees.

Why Choose The Probate Bureau in Ware and Hertfordshire

The Probate Bureau has been serving families across Ware and Hertfordshire since 1999. Our reputation is built on professionalism, compassion, and efficiency. We are recommended by over one thousand funeral directors, which speaks to the trust placed in us by those working at the heart of bereavement services.

We provide clear, fixed-fee pricing so you will never face unexpected charges. Our grant-only service starts at £950 plus VAT, and we offer full administration packages tailored to your circumstances. Most estates are completed far quicker than the national average, giving families confidence that matters will be resolved without delay.

In addition to probate, we also provide will writing, inheritance tax planning, Lasting Powers of Attorney, and trust creation. This means you can access a complete suite of services under one roof. Our membership of professional bodies and compliance with strict regulatory standards ensures that your estate is handled with integrity and care.

Perhaps most importantly, we are a local team based in Ware. We understand the needs of families in Hertfordshire and provide a friendly, accessible service. Whether you are dealing with the estate of a loved one or planning your own affairs, we can guide you through every step with compassion and expertise.

Conclusion

Probate is a vital but often daunting process. While it is possible to handle it yourself, the risks of mistakes, delays, and stress make professional help an attractive option for most families. The costs of probate services vary, but clear fixed fees and efficient service mean that professional support is often more affordable and quicker than people realise.

At The Probate Bureau in Ware, we pride ourselves on being a trusted partner for will and probate services across Hertfordshire. Our combination of expertise, local knowledge, and transparent pricing ensures that you and your family can navigate this difficult time with confidence.

If you are facing probate, need to update your will, or want to plan for the future, we are here to help. Let us take on the burden so that you can focus on what truly matters: caring for your family and remembering your loved one.

Back To BlogShare This Post

Recent posts

- 10 Legal Ways to Reduce Inheritance Tax in the UK (2026 Guide) By Admin , 27/11/2025

- Gifting Assets – How Lifetime Giving Can Lower Your Inheritance Tax Bill By Admin , 27/11/2025

- How Long Does Probate Take? Understanding Every Stage of the Process By , 04/11/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

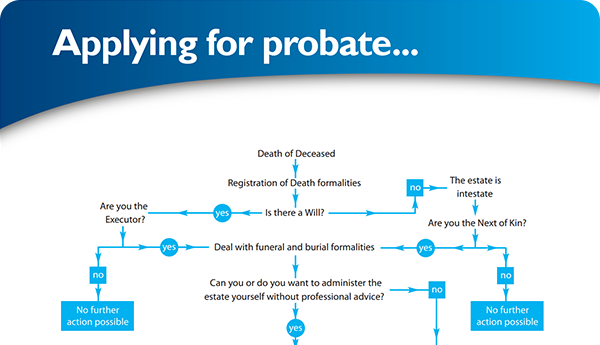

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×