Making the Right Choice for Your Family’s Estate

DIY vs Professional Will and Probate Services

Introduction

When a loved one passes away, dealing with their estate becomes an unavoidable responsibility at an already emotional time. Families are often faced with the important decision of whether to handle probate themselves or to seek professional help. On the surface, probate can seem like little more than completing paperwork, but in reality, it is a detailed legal process with strict requirements and potentially serious consequences if handled incorrectly.

At The Probate Bureau, based in Ware and serving families across Hertfordshire, we specialise in guiding clients through every step of probate, wills, and estate planning. This article explores what probate involves, the pros and cons of managing it yourself, when professional support becomes essential, and the associated costs so you can make an informed choice that is right for your family.

Understanding the Probate Process and Your Options

What Probate Really Involves

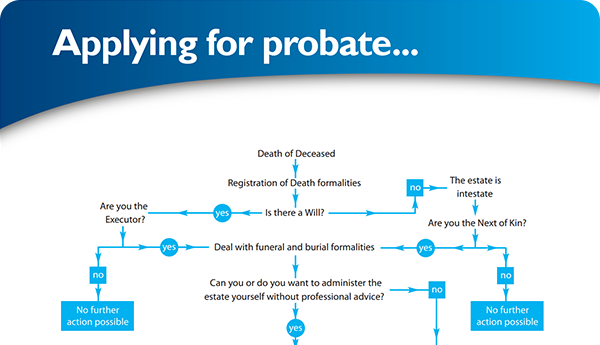

Probate is the legal framework for administering a deceased person’s estate. It includes validating the will, collecting assets, settling debts, and distributing the inheritance to the rightful beneficiaries. If there is no will, intestacy rules determine how the estate is divided, which often adds to the complexity.

The process extends well beyond filling in a few forms. Estates that involve property portfolios, investments, or inheritance tax liabilities require meticulous attention to legal obligations and deadlines. A single oversight, such as failing to declare assets properly or missing a creditor claim, can result in serious delays, financial penalties, or even personal liability for the executor.

Understanding these responsibilities from the outset helps families decide whether they have the time, knowledge, and emotional capacity to manage probate independently, or whether professional support would provide a safer and more efficient outcome.

The DIY Probate Approach: Benefits and Risks

Some families are drawn to DIY probate because it appears to save on legal expenses. The government provides online guidance and standardised forms, which can make the process look accessible. For very simple estates with minimal assets, no property, and straightforward beneficiary arrangements, DIY probate can be a viable option.

However, executors should weigh the risks carefully. Taking on probate without expert help means you are personally responsible for distributing the estate correctly. If mistakes are made, such as failing to identify a creditor or misinterpreting the rules of intestacy, you could face disputes, legal action, or financial liability.

The complexity of estates increases quickly when there are multiple properties, foreign assets, business interests, or inheritance tax to pay. Executors often find that what seemed manageable at first becomes overwhelming once the full scope of responsibilities becomes clear. In these cases, DIY probate can end up being more stressful, time-consuming, and costly than anticipated.

When Professional Probate Services Provide Essential Value

Recognising Complex Estate Scenarios

Professional probate services become particularly valuable when estates involve more than the basics. Solicitors and probate practitioners have the expertise to calculate inheritance tax, manage property valuations, transfer business assets, and deal with overseas elements of an estate. These are areas where even small errors can have serious financial implications.

Situations that usually require professional intervention include estates above the inheritance tax threshold, estates with multiple beneficiaries, contested wills, intestate estates, and family disputes. Professionals are also skilled in dealing with HM Revenue & Customs, the Probate Registry, and banks, ensuring that all correspondence and legal formalities are completed correctly.

While there is a cost involved in appointing a probate professional, many families find it is ultimately more cost-effective when weighed against the potential for mistakes, delays, and penalties.

Professional Protection and Peace of Mind

Another major benefit of professional services is the protection they provide. Qualified probate practitioners carry professional indemnity insurance, which means executors and beneficiaries are safeguarded against potential errors or omissions. DIY approaches cannot offer this level of protection.

In addition, professional practitioners do more than handle paperwork. They provide families with reassurance, clarity, and compassionate support during what can be an emotionally difficult time. Having an experienced and impartial advisor often makes it easier to navigate both the legal requirements and the sensitive family dynamics that probate can bring to the surface.

Comprehensive Estate Planning: Beyond Probate

The Importance of Wills and Powers of Attorney

Good estate planning goes further than simply preparing for probate. Having a valid will ensures your wishes are clearly set out and legally enforceable, making probate easier and faster for your beneficiaries. Without a will, estates default to intestacy rules, which may not reflect your wishes and can cause confusion or conflict.

Lasting Powers of Attorney (LPA) are another essential part of planning. These allow trusted individuals to manage your finances or healthcare decisions if you lose the ability to make them yourself. Without an LPA in place, families may face lengthy and expensive court processes to gain control over important decisions.

Professional estate planners can ensure these documents are correctly drafted, legally compliant, and updated when circumstances change. This proactive approach reduces complications and helps families feel more secure about the future.

Facilitating Family Conversations About Inheritance

Talking about inheritance can feel uncomfortable, yet open conversations offer huge benefits. Discussing your plans in advance can reduce uncertainty, prevent misunderstandings, and reassure your family. It also allows you to explain your choices and help your executors prepare for their role.

Professional advisers can help guide these conversations in a neutral and constructive way. This support ensures that sensitive topics are handled with care and that family members are prepared for what will happen when the time comes.

Making Your Probate Decision: Factors to Consider

The decision between DIY probate and professional support depends on several factors, including the size of the estate, the number of beneficiaries, the presence of property or business assets, and whether inheritance tax applies. It also depends on your personal capacity to deal with complex paperwork during an emotional time.

For very simple estates, confident individuals may decide to manage probate themselves. However, for most estates, even an initial consultation with a probate professional is advisable. It helps identify potential complications and ensures the estate is managed correctly from the start.

When considering the options, families should also reflect on their emotional wellbeing. Grief can affect concentration and decision-making, and probate is an area where detail matters. Professional support provides not only technical expertise but also relief from the burden of administration at a difficult time.

Costs of Probate Services

Court fees and disbursements form the basic costs of probate. The application fee for estates valued over £5,000 is currently £300, with small additional charges for extra copies of the grant and related services.

Professional fees vary depending on the provider and the estate. Some solicitors charge a percentage of the estate, often between 1 and 5 per cent plus VAT. Others charge hourly rates, typically between £300 and £400. Increasingly, fixed-fee services are available, which give families greater certainty about the final cost.

At The Probate Bureau, grant-only services start from £950 plus VAT, while full estate administration is quoted on a fixed-fee basis according to the size and complexity of the estate. This transparent pricing means you always know what to expect.

Why Choose The Probate Bureau in Ware and Hertfordshire

The Probate Bureau has been supporting families across Hertfordshire since 1999. Based in Ware, our team is committed to providing practical solutions with compassion and professionalism. We are trusted by more than a thousand funeral directors who regularly recommend our services.

We offer competitive fixed fees, fast turnaround times, and the reassurance that comes from working with qualified and regulated professionals. In many cases, we can complete probate within three to six months, which is significantly faster than the national average.

Our services extend beyond probate to include wills, trusts, inheritance tax planning, and powers of attorney, providing families with a complete estate planning service under one roof.

Conclusion

Probate is an important but often complex process. While some families may choose to manage it themselves, the risks, responsibilities, and potential delays make professional services a better option in most cases. The cost of expert help is usually outweighed by the benefits of efficiency, accuracy, and peace of mind.

At The Probate Bureau, we are proud to be the trusted partner for will and probate services in Ware and Hertfordshire. Whether you need full estate administration, a grant-only service, or broader estate planning support, our experienced team is here to help you every step of the way.

For advice tailored to your situation, visit The Probate Bureau and speak with our friendly, knowledgeable team today.

✅ Ready to paste into your CMS raw HTML editor. Do you also want me to provide a shortened meta title + description (55 & 150 characters) separately for your SEO plugin fields (Yoast / Rank Math)? Ask ChatGPT Back To BlogShare This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×